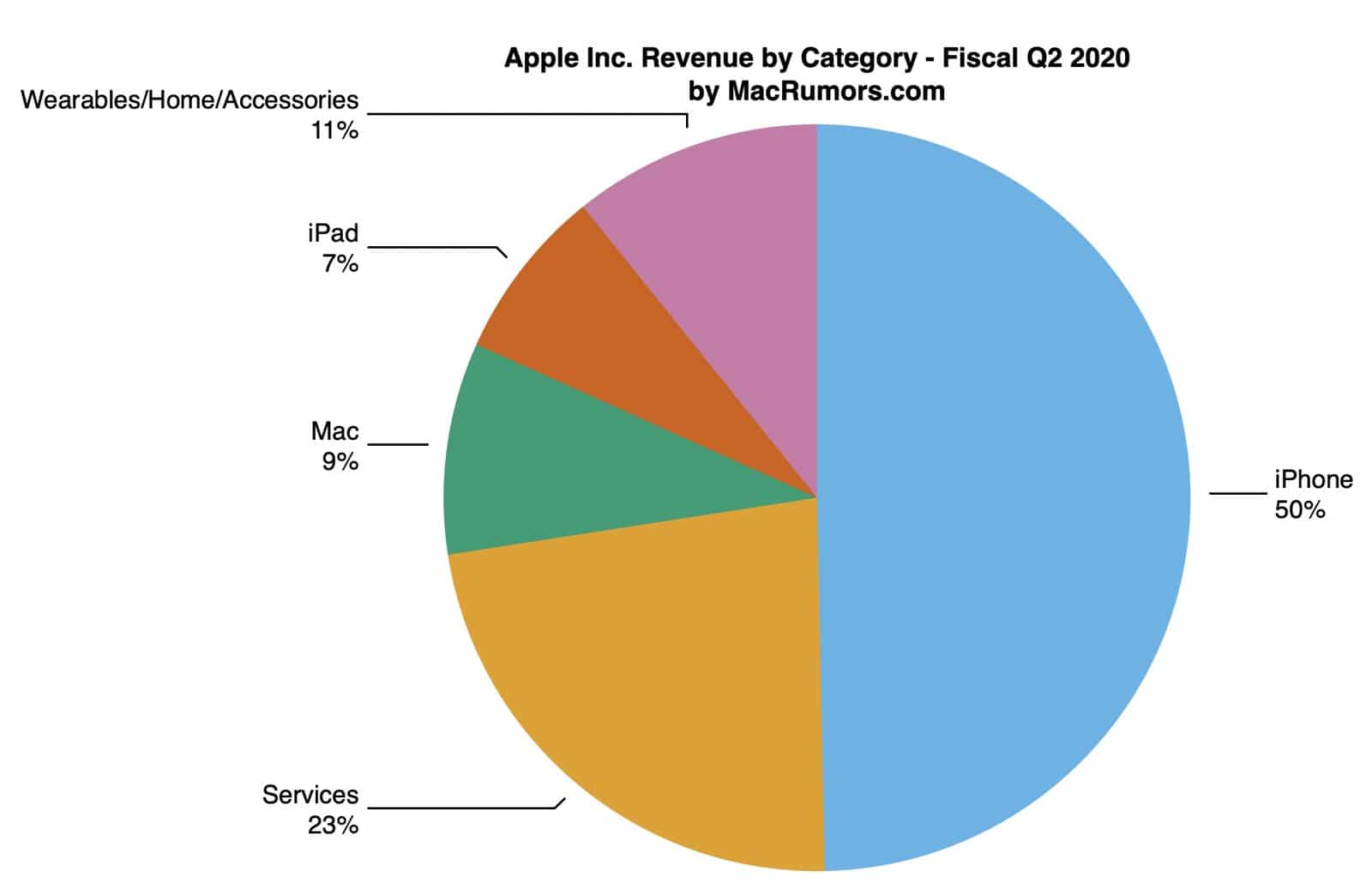

Here’s a different theory for why Apple would make such an aggressive decision. Charlie Munger once said, “Show me the incentive, I’ll show you the outcome.” To understand Apple's incentive, we need to better understand who their clients are. Apple reports for Q2 2020 show that selling hardware accounted for 77% of Apple's revenue, while services accounted for the remaining 23%.

Apple services itself is comprised of many products - Apple Music, App Store, Icloud, Itunes, Apple Books, Apple Pay, AppleCare Licencing, and more. In terms of revenue, the only product that is related to advertising is the App Store, but, even here, most of the revenue is driven by app downloads that came from search or in-app purchases and not from paid advertising.

Upon understanding that Apple’s revenue has little to do with advertising, figuring out an alternative agenda for IDFA and Safari changes becomes easier. Apple’s clients are the end-users buying hardware and services, so the incentive is to please them and gain more market share by answering the trend of users demanding more privacy. Taking more advertising dollars from the market can be a nice upside, but not the main agenda.

Also, Apple blocking dozens of 3rd party trackers also earns them trust from their already loyal base of consumers. Those consumers won’t mind Apple using first-party data as long as Apple is the sole company to gain access and they commit to not sharing this data with other ad tech companies they never heard of.

Apple's incentive to gain market share along with recent privacy trends will result in more privacy initiatives in the Apple ecosystem, regardless of what Tim Cook’s company decides to do in the ad space. This can help us tackle the elephant in the room, how Google will react.

The Google Angle

Google has a diverse revenue stream, so they need to balance more types of clients and incentives - brands, agencies, publishers, O&O assets (YouTube, search etc), Android and, finally, the end-user.

Because there are more types of incentives, analyzing the outcome becomes harder. This is why I believe Google hasn't made up its mind on what to do. It releases ideas to the market to figure out how the public and the industry will react, while buying time for new technologies and trends to emerge.

My prediction is that the incentive map for google will change and Google will do the same thing Apple is doing, the reasoning behind it is again, the incentive map. As time goes by we will see two trends. Growing pressure from users demanding more privacy combined with some good tech currently being developed to support a cookieless ad ecosystem. Those two trends will change the incentive map enough so it will be in Google’s best interest to do the same thing Apple did and is still doing.

Conclusion

Looking at the incentive map it is easier to understand that it was in Apple best interest to kill 3rd party cookies and IDFA sharing. As a company that mainly sells hardware and user experience, their clients pay extra to enjoy the closed garden Apple experience. Apple might use this opportunity to gain a new ad revenue stream, but there is a small upside and it won’t be the main incentive for their actions.

Google seems to be stalling as the balance between privacy and revenue is not decisive yet. As time goes by, the threat for the advertising part of the business will grow smaller and the potential harm from the user part of the business will grow larger. This pincer movement will change the incentive map for Google and it will ultimately be in their best interest to do what Apple is doing now. When they do, it won’t be to control publishing, fight facebook, or because of any other conspiracies. It will be because changing incentives drive changing outcomes.