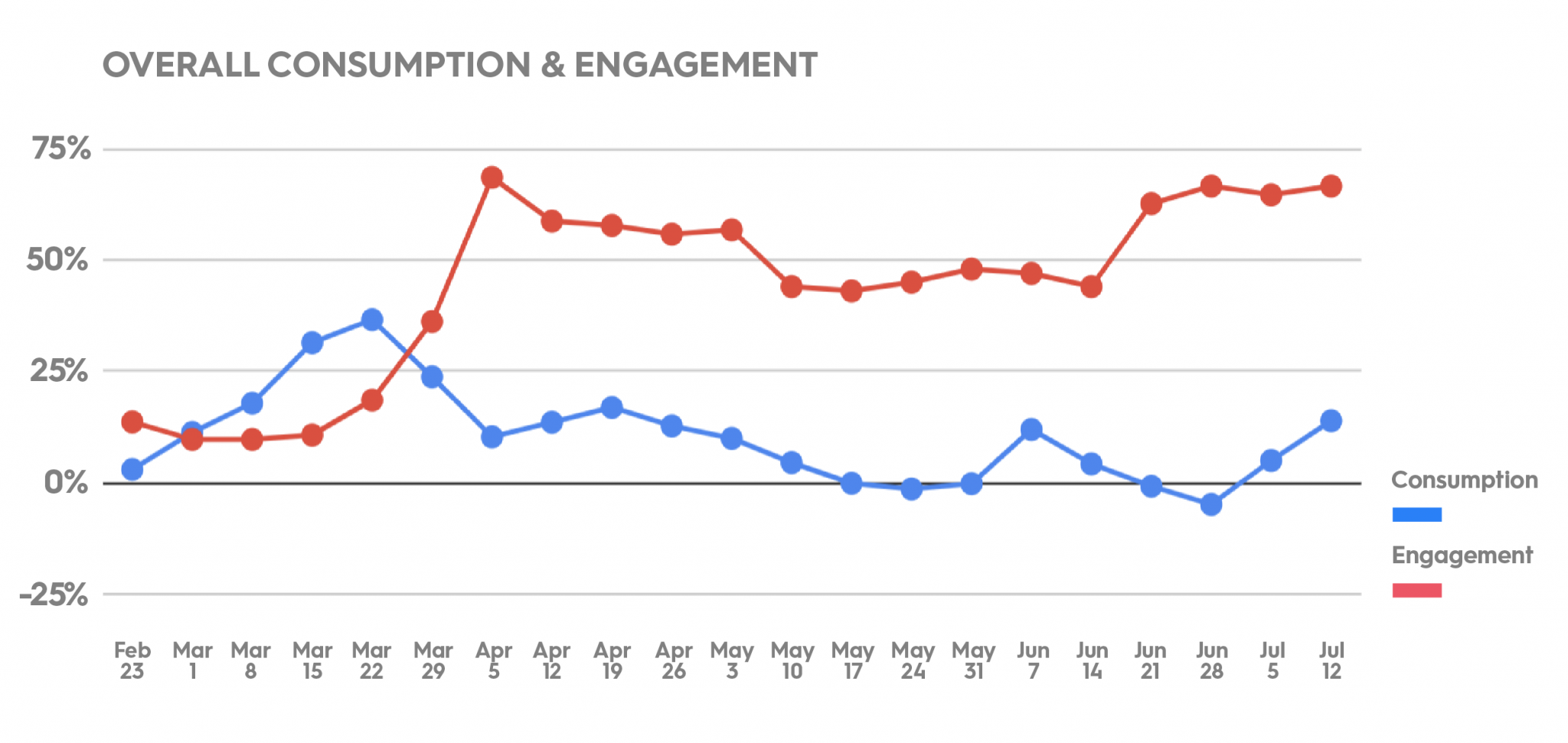

Quick reminder: User engagement rates (ER) are an important indicator. When engagement rates are high, it signifies that users are more immersed in the content that they are viewing. The rates since the lockdown, across the board, have been very positive. While this could be partly attributed to improvements in Primis’s Discovery Algorithm, that is not the only reason users are more engaged with video content than before.

After analyzing data points from all categories across the Primis publisher network, we were able to paint a picture of what is happening across the different verticals. We’ve again provided both how many are interested in a certain category (measured by overall impressions), and also how interested they are (measured by user engagement).

Key Takeaways

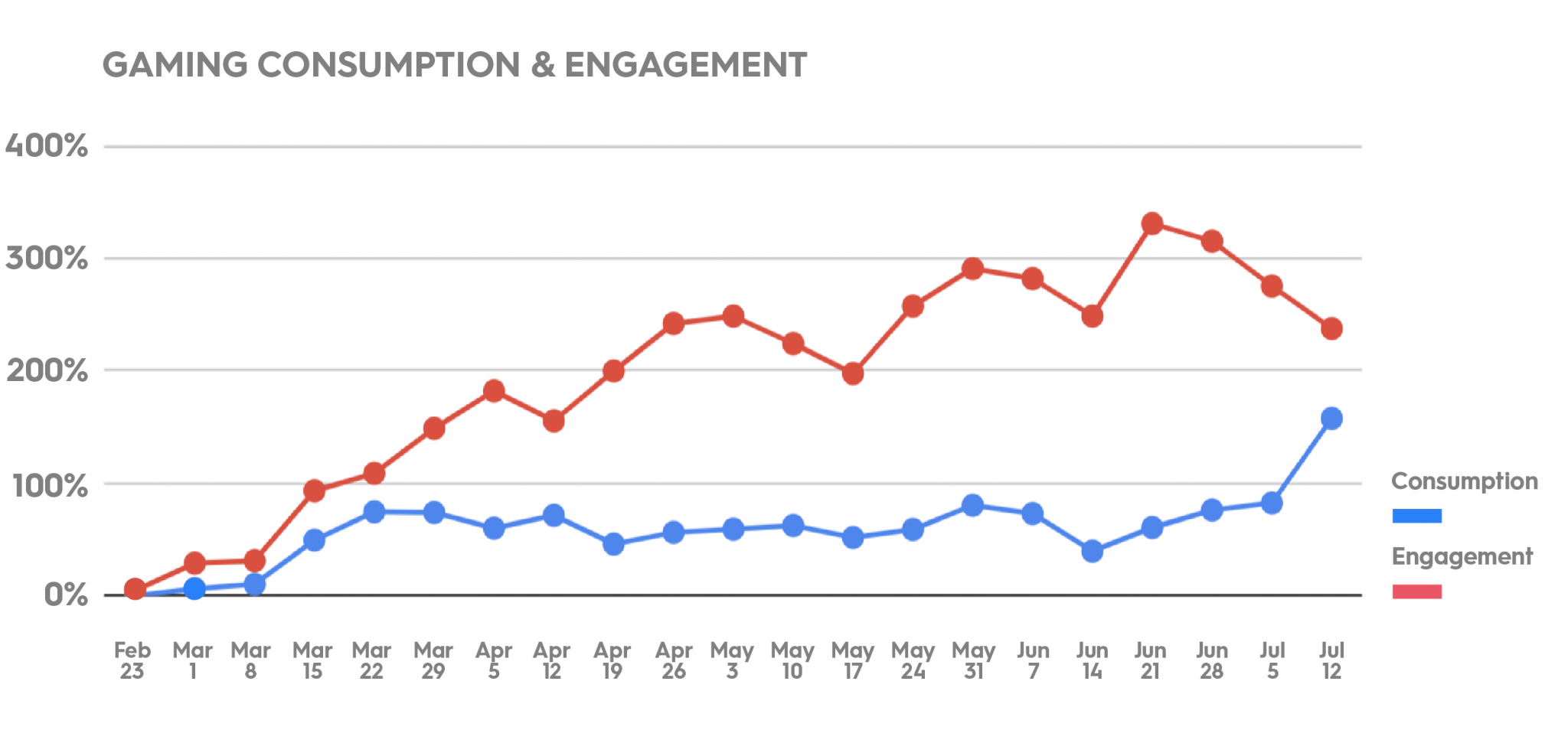

It seems as though the Gaming vertical is the category that is growing the strongest, not only doubling (!) the consumption but almost tripling engagement rates. With such a strong and consistent trend, gaming could be seen as symbolic of the COVID/lockdown era, representing a growing form of escapism combined with an engaging activity that doesn’t require groups of people or leaving one’s home.

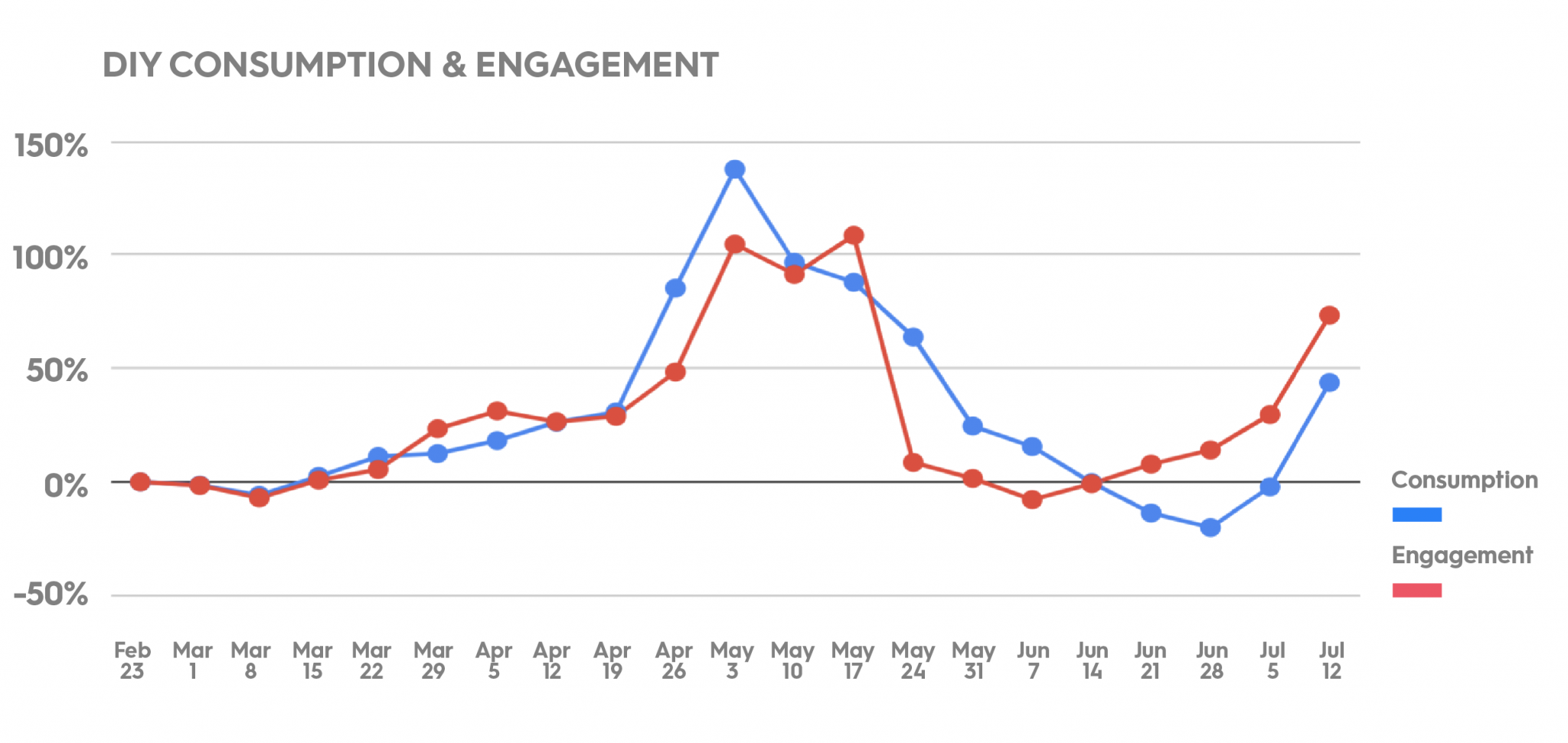

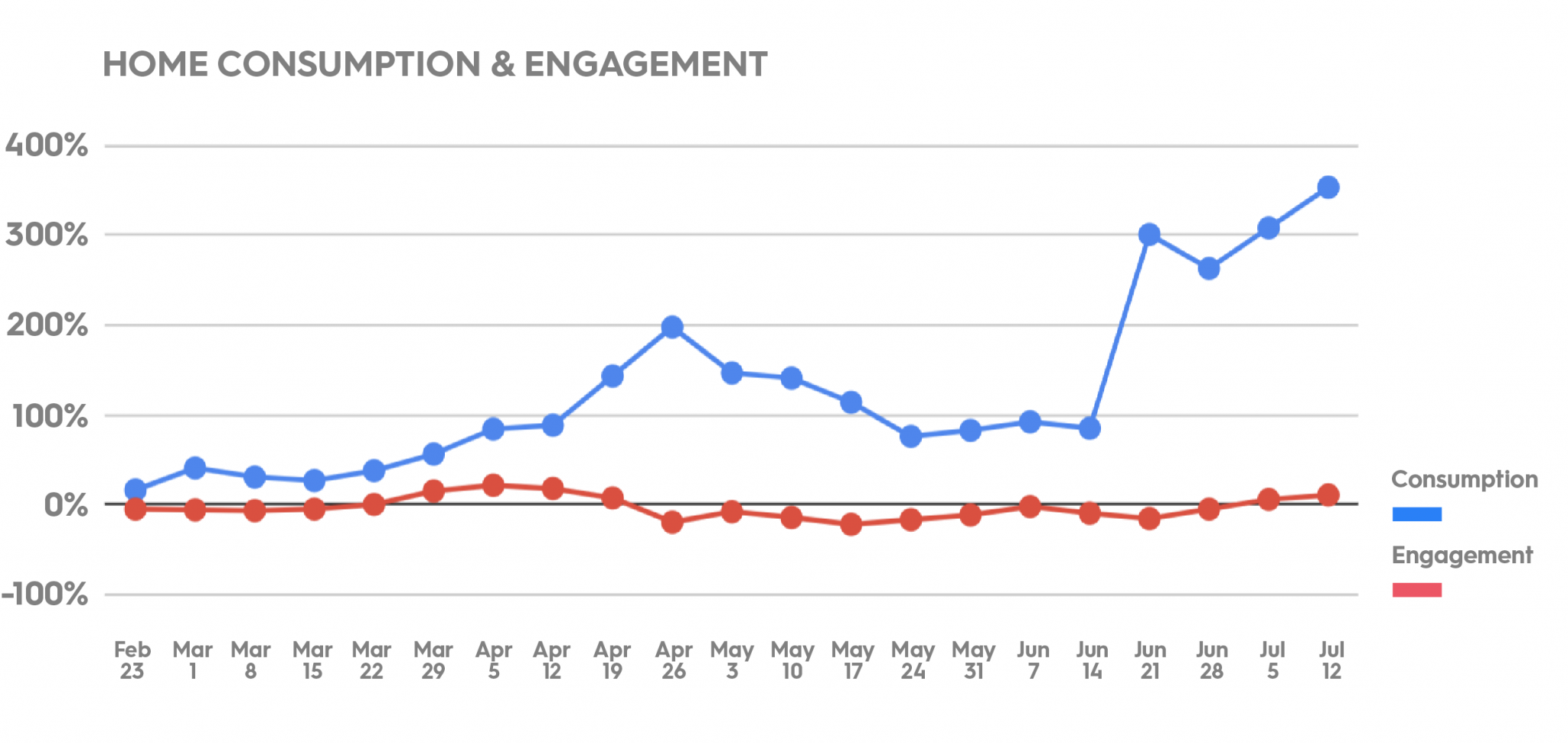

The DIY and Home categories have shown strong growth at the start of the lockdowns, both in consumption (85% and 198%, respectively) and in engagement rates (48% and 22%, respectively). However, in May, they dropped in both metrics. Over the past few weeks, they are showing a strong recovery. This may be because people are realizing that they may be in this situation for the long haul and that improving their home experience is therefore more urgent.

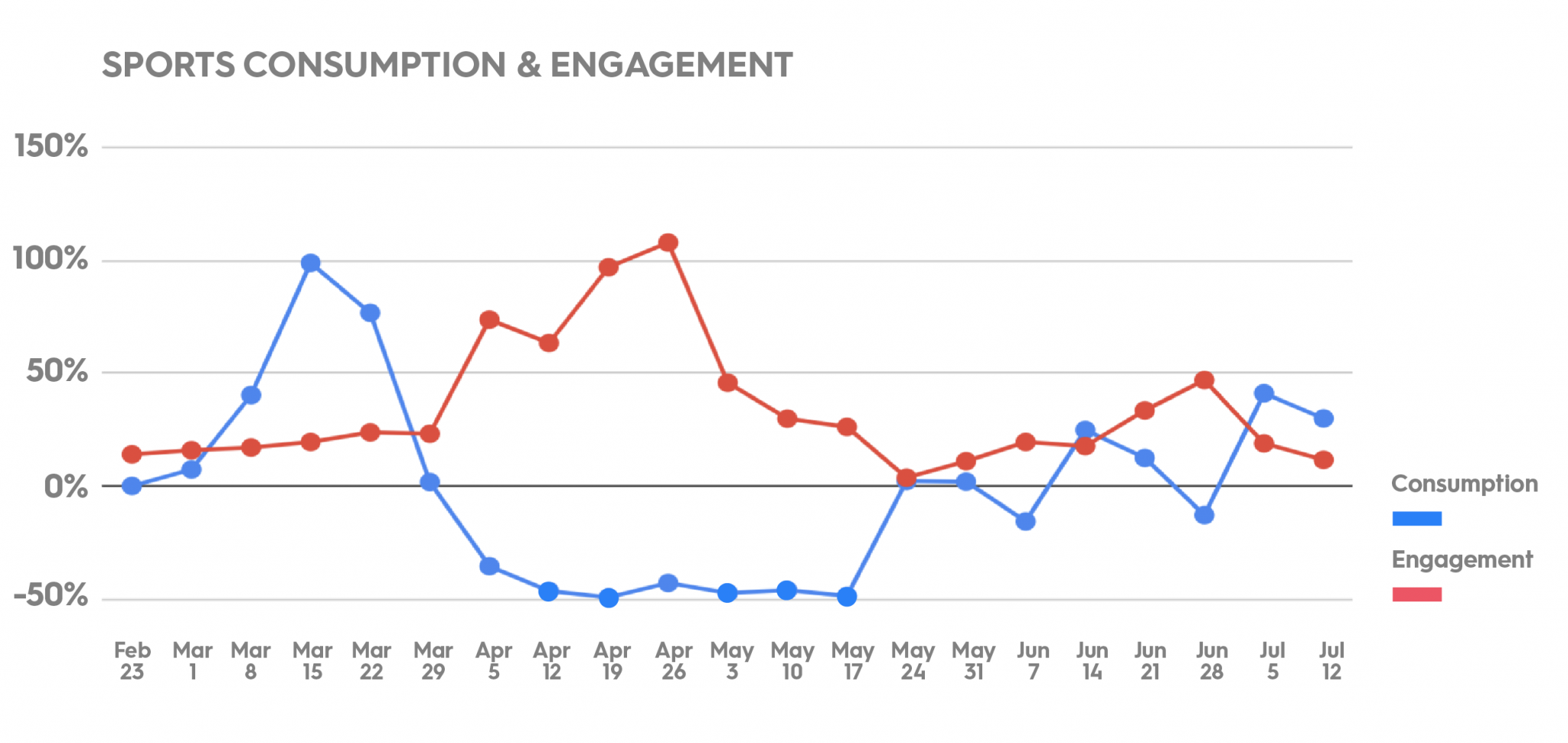

Sports is the most exciting part of this index with a bounce back to pre Covid-19 numbers in terms of consumption (and even reached a 41% increase over them in the second week of July). The Engagement rates are soaring as well (47% increase at the start of July) - the sports-starved crowd is eager to consume content on the recently restarted NBA season and playoffs, the baseball season, PGA golf and more. The positive trend isn't slowing down for the past 8 weeks.

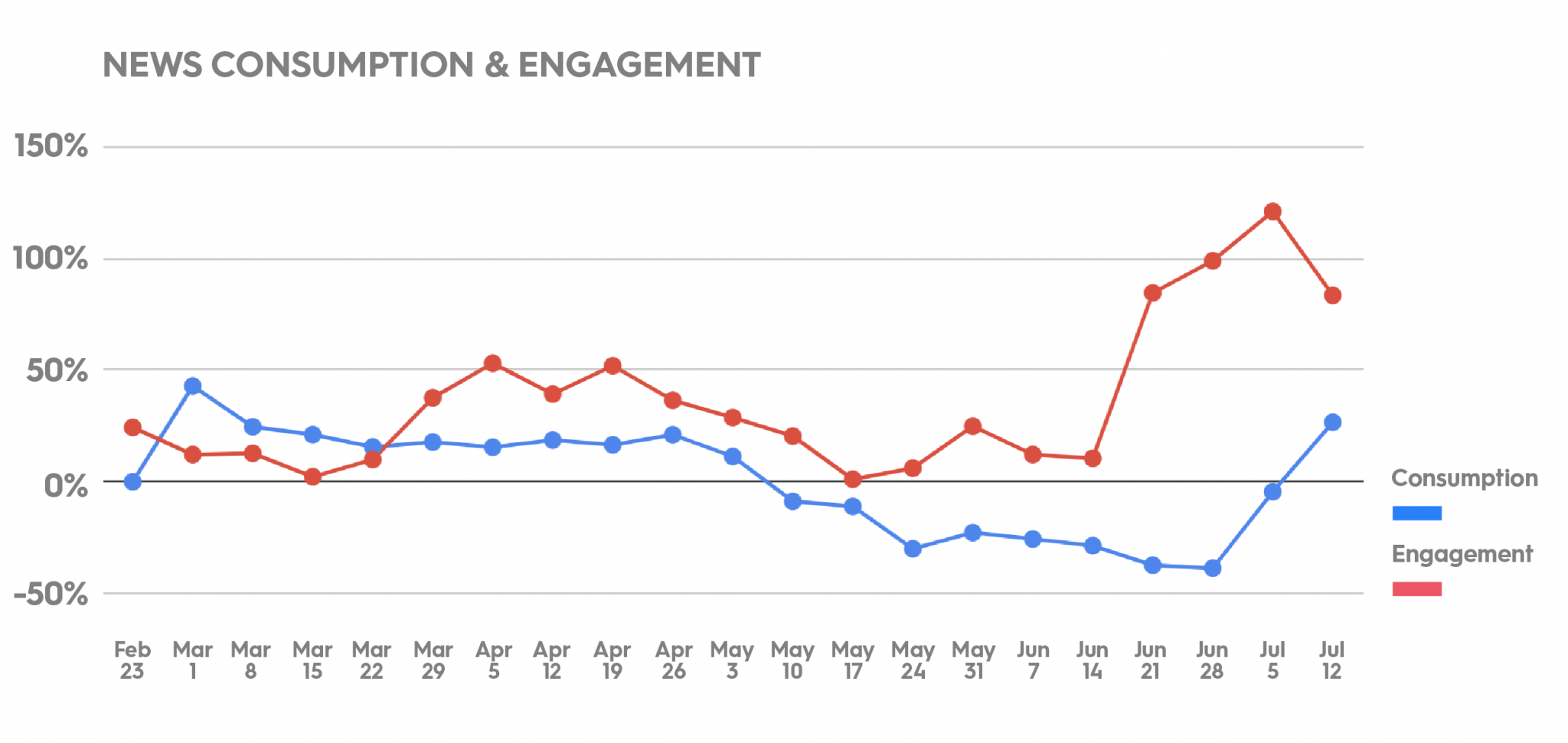

In the News category, after an initial uptick, there has been a consistent, slow decline in the past months. It is a possible indication of people wanting to block out the bombardment of worrying news. However, in the past few weeks we are seeing a rise both in consumption (26%) and engagement rates (83%), perhaps due to the upcoming elections and a more hopeful outlook with vaccines pending and public areas reopening.

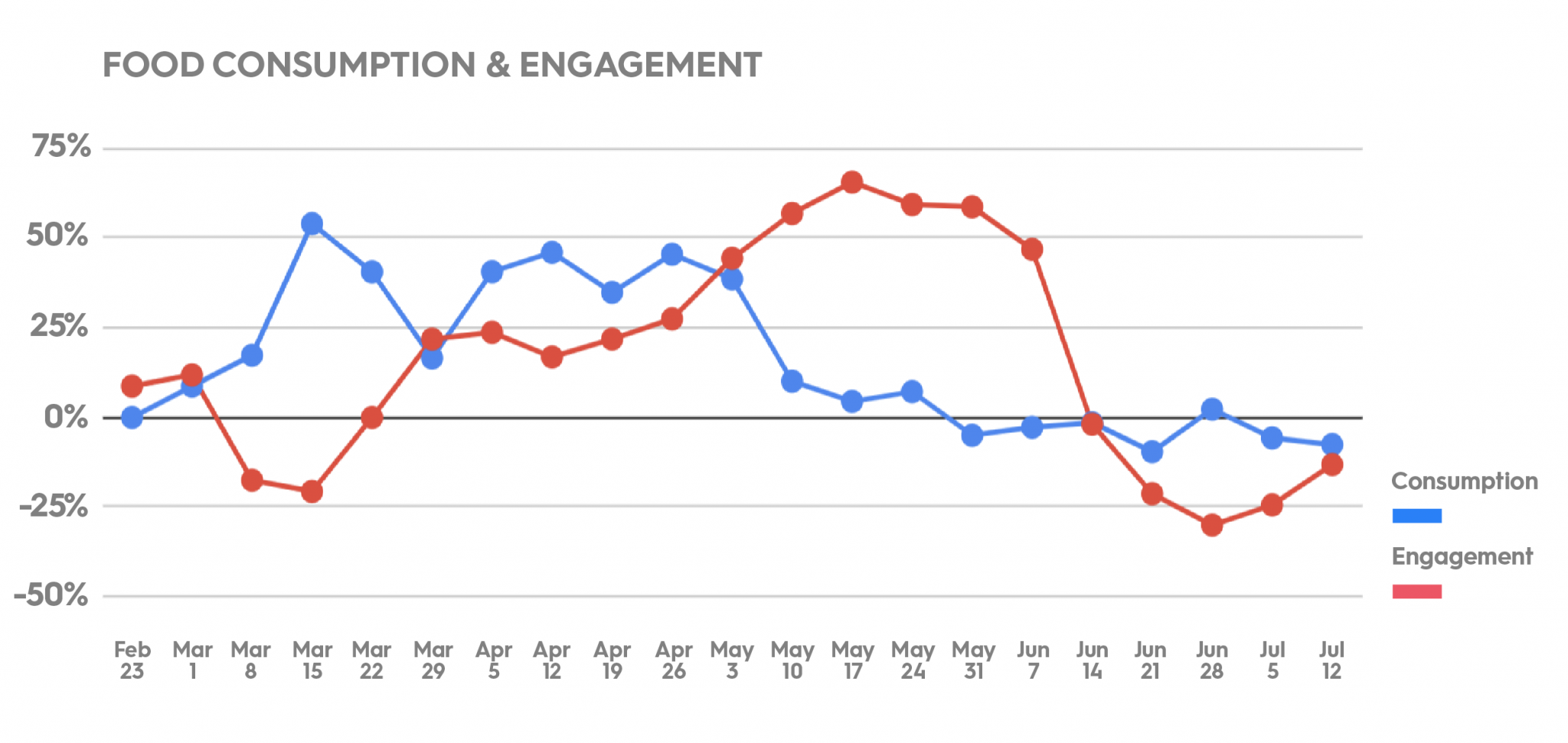

The Food category has been showing interesting fluctuations. The category started strong at the beginning of lockdowns, probably people wanted to learn how to cook at home as eating out was no longer an option. Soon after, came a steady decline in consumption, which seems to show that either people memorized their recipes, tired of their cooking, or that delivery and pickup systems adapted to the new situation. Or all of the above.

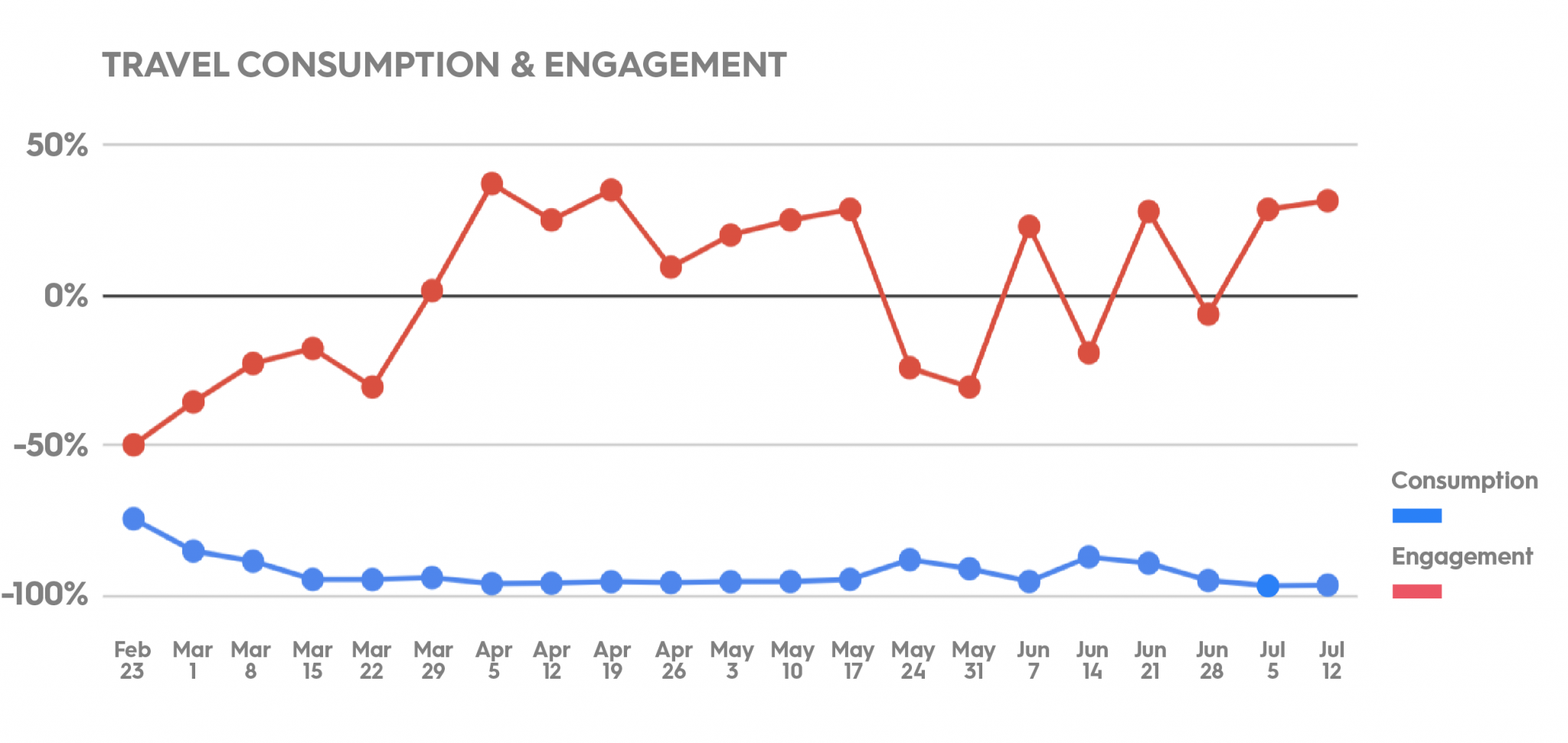

Unfortunately, the Travel category is yet to see any significant uptick. Even travel from home initiatives didn’t pick up any steam. However, expect it to make a comeback, much like sports did, when the time comes.

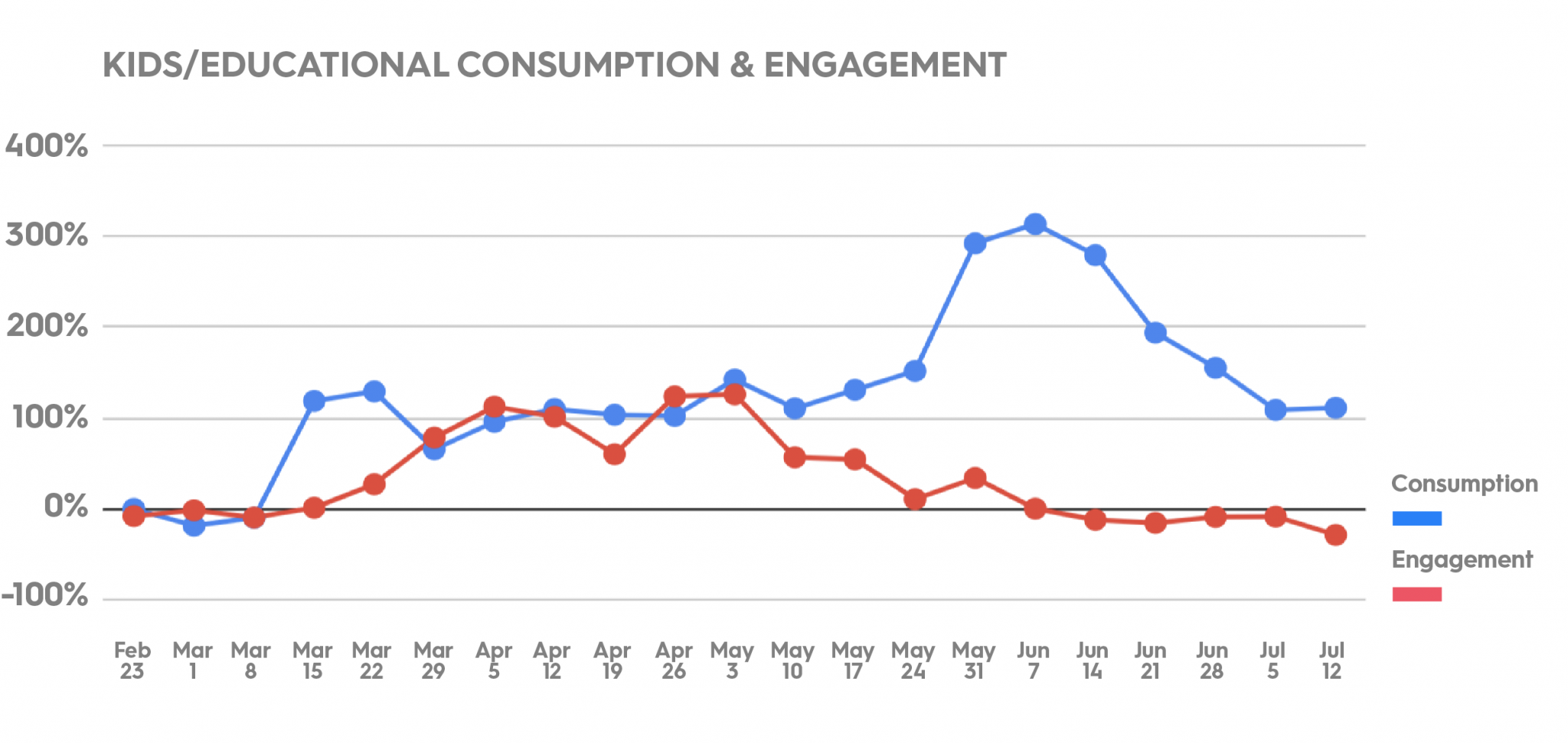

The Kids / Education vertical, a topic of great controversy and debate in certain parts of the world, is starting to normalize in terms of impressions after a long stretch of increased consumption. This is likely due to the summer break and the possible reopening of schools.

The Numbers by Category

The benchmark for all graphs are impression numbers and engagement rates from the start of February.

News

While we’ve seen an increase in consumption since early March, there was a steady decline starting in early May that has been rebounding in the past couple of weeks.

Sports

Consumption in March was very high, followed by an understandable crash. Since the second half of May it has shown consistent growth, coupled with a growth in engagement.

Gaming

The big growth in consumption since the beginning of lockdowns has since stabilized. Interestingly, the rise in engagement is keeping on growing, reaching 331% growth at one point.

Food

Here we are seeing a disparity between the first and second phases of the lockdown. While, at first, consumption and engagement grew significantly, the second part showed a decrease in consumption to pre-lockdown levels.

Travel

The vertical has experienced an expected drop of 95% in consumption rates. While the end of May and start of June showed some minor signs of recovery, the trends have flattened again.

DIY

Having experienced a powerful and long-term growth since the start of the pandemic, the DIY category saw a drop from mid-May to pre-lockdown levels, both in engagement and consumption. However, there has been a positive trend over the past couple of weeks.

Home

A very consistent rise in consumption of Home-related content, while the engagement rates have remained stable.

Kids/Educational

The lockdown has promoted a huge uptick in consumption and engagement rates. After a huge initial 300% jump, there has been a correction, possibly due to public places reopening and summer break from homeschooling.