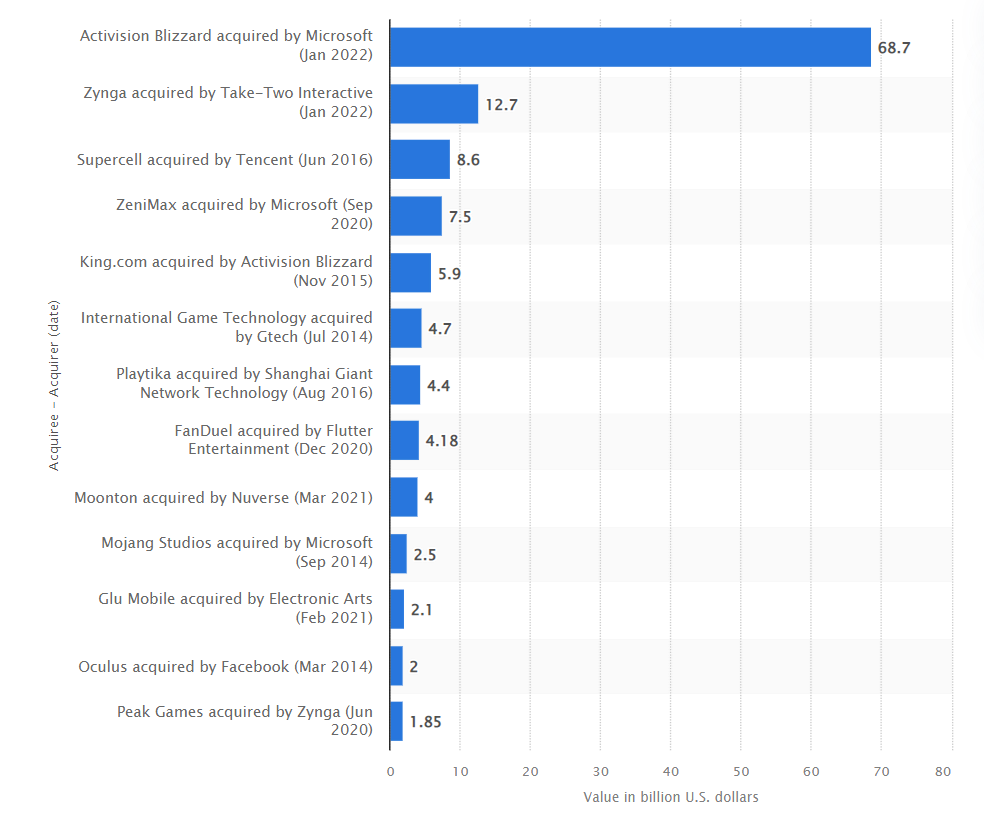

The acquisition will further accelerate the software giant's gaming business growth across mobile, PC, console, and cloud. Microsoft has been acquiring gaming companies for some time now, for example, Mojang, creators of the popular game Minecraft, for $2.5 billion in 2014. The deal is still pending approval, and it's not the only one in the pipeline. More are set to blow the industry out of the water this year. We're taking a look at the massive increase in the amount of M&As in the gaming space over the last decade to see how it impacts digital publishers.

Why are companies buying into gaming?

Gaming has always been popular; gamers of the 80s and 90s have grown up and now head gaming companies. This generation is the first in the industry to have grown up as gamers themselves. Their passion and understanding of the environment have helped the industry evolve and are fuelling the drive. That's not to mention the move online over the last decade, fast-forwarded by the pandemic. With Covid forcing people inside, looking for things to take up their time and a way to communicate with others, gaming was the perfect outlet. Immersed in virtual worlds and communicating with other online players, the industry saw a 39% increase in time spent gaming during the initial outbreak of Covid in 2020.

With a markable increase in market value and gaming time, big opportunities are to be had, and it's not gone unnoticed. In Q4 2020 alone, 75 M&A deals were announced. Nearly double the number in Q4 2019. So, who's pulling up a seat at the table, and where is the money?

The Money Stream - Who’s playing and how are they paying?

With the pandemic skyrocketing the already popular gaming industry and big money rolling in, PC and console gaming attract a highly loyal target audience, meaning the stakes are high for both publishers and advertisers in the gaming vertical. Gone are the days when a gaming community consisted of the neighborhood nerds sat in their bedrooms, sending text messages over their commodore 64. Gaming exploded, and gaming communities went mainstream.

This loyalty is further enhanced by subscriptions that also bring in the moolah. Think; Gears of War and Forza Motorsport, two popular Xbox and Microsoft titles. An Xbox game pass subscription gives access to these and other much-loved titles. Thanks to their resources, large companies can also cross-promote. For instance, Microsoft promotes a roster of games under its umbrella, including Minecraft, the Tomb Raider trilogy, State of Decay, and soon also Call of Duty.

Notable gaming acquisitions to date

- Embracer Group bought Asmodee for $3 billion. (Dec 2021)

- Shareholders of Codemasters approved the $1.2 billion acquisition offer from EA.

- The European Commission approved Microsoft's $7.5 billion deal to acquire ZeniMax Media, the parent company of Doom and Fallout studio Bethesda Softworks. This made Microsoft the proud owner of 23 1st party game studios.

- EA acquired mobile game developer Glu Mobile for $2.1 billion in enterprise value.

- Blizzard acquired King.com for $5.9 billion. (Nov 2015)

Source: https://www.statista.com/statistics/1248063/biggest-video-game-industry-acquisitions/

How is the gaming industry performing?

M&As add funding and the required resources to publish better games quickly. For example, Naughty Dog, the publisher of the popular Uncharted and The Last of Us series, was acquired by Sony back in 2001. The result? An exclusive series of best-selling, award-winning games that drove exponential revenue and demand like no other gaming publisher.

2021 was another record-breaking year for the gaming industry, with an estimated market value of $173.7 billion. In particular, companies from the Asia-pacific region (e.g., Sony, Nintendo, and others) produced $88.2 billion in 2021, with a 30% year-on-year increase. 2022 is now off to a flying start; Microsoft will acquire Blizzard, Take-two interactive will purchase Zynga, and Sony is purchasing Bungie, and we can expect many smaller purchases to go through.

What's the publishers' take on all this?

We spoke to Mariusz Klamra, CEO at GRY-OnLine SA. The company owns a group of gaming and electronic entertainment sites, including Gry-Online and TVGry.pl, Gameplay.pl, and GamePressure.com. Here's what he had to say;

“I am not sure Microsoft's acquisition will go through because it could limit the games to their platform, which might not be allowed. However, they have said some titles will still be available on PlayStation for some time after the acquisition goes through.

But there's also an issue with sharing internal knowledge. If you have a popular game like Call of Duty run on Playstation, this could stop the acquisition because they [gaming companies] don't want Microsoft to have access to Playstation players and the data.

There are two types of M&A trends we are focusing on:

1. Large companies buying gaming developers, e.g., Microsoft/Activision and Sony/Bungie. These [M&As] are detrimental to players. The major new titles will no longer be available on PlayStation and only on Xbox or vice versa. Building a walled garden and preventing competitors from accessing major franchises. Interestingly, Microsoft and Sony don't raise objections to investment in PC games, as they don't perceive PC gaming as competitive to their platforms but complimentary. That results in PC players having the broadest market offering, with access to both Sony and Microsoft's title portfolio. This is, however, offset by the general expensiveness of the PC platform for AAA titles.

2. Medium-sized companies buying smaller developers. They leave them with the ability to push their own agendas after the acquisition. They only supply them with working capital and marketing/business support and know-how but leave the original developers with control over the artistic vision. I like this trend much more and embrace it. E.g., Embracer completed over 70 acquisitions of independent studios. It's a very interesting angle because it provides the market with diversity. In comparison, bigger franchises like the game Call of Duty can't be easily tinkered with, as there are more restrictions and risks to the studio.”

What's the next step?

Undoubtedly, the gaming world has massively evolved over the last few decades. In 2021, there were an estimated 3.24 billion gamers across the globe. With this drive in the industry, advanced tech, and gamers' unique loyalty, it's no wonder that everybody wants to get in on the action. As such, we've seen an explosion in gaming M&As hitting the headlines. Now is the time for publishers to capitalize on the hype, the market for content in this sector is so strong, and there is plenty for publishers to play for. What can publishers expect from this booming sector, and will large companies be interested in purchasing gaming publishers as well?