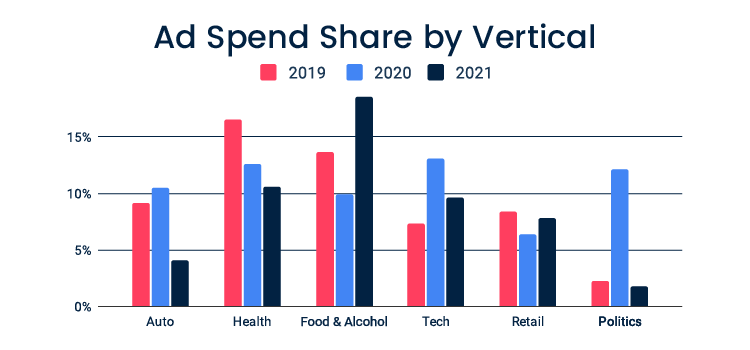

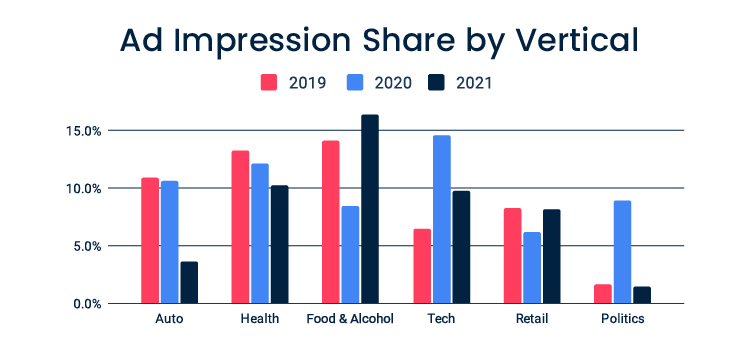

To help publishers and advertisers better understand this year's holiday-shopping landscape, we've pulled data from our demand partners for October 2019 to 2021. We're taking a look at the share of ad spend and impressions in six top industry verticals to assess how they responded and predict trends for the upcoming holiday season.

Food and Alcohol

We saw the biggest drop in the share of ad spend and impressions for the food and alcohol industry in 2020, compared to the other sectors we looked at. With no vaccines and lockdown in place, people were not going out, and there were no holiday parties. Now spending has recovered and is doing better than in 2019. Businesses expect customers to host more holiday gatherings this year, with bigger spreads of food for friends and family.

While we saw a considerable drop, 29% in ad spend share from 2019 to 2020, this industry is also experiencing the best recovery. There was an increase of 47% in the share of ad spend in 2021 compared to last year, surpassing 2019 levels. Unable to enjoy the holidays together last year, it's clear that this year people are keen to eat, drink, and be merry.

Tech

Tech surged last year, and other than politics with high ad spend due to the elections, there was a significant jump in both impressions and ad spend. Again, this follows the change in consumer behaviors over the pandemic, with people working remotely from home. Since the vaccines and return to the "new normal," there has been a drop, however, it still remains much higher than the pre-pandemic levels of 2019.

For impressions, we saw a 56% increase in 2020 compared to 2019, and ad spend was similar, with a rise of 46%. At the same time, they dropped by around a third for impressions and a quarter for ad spend, but are still higher in comparison to 2019, between 30- 35% for impressions and ad spend. The industry is holding firm and perhaps changed forever, as we expect continued growth in the sector.

Automotive

Automotive digital advertising had been on the rise in the years leading up to the pandemic. Even as Covid hit last year, digital ad spend increased by 22 percent. Automotive advertisers have evolved from relying heavily on linear television and its declining reach to programmatic advertising to reach larger audiences on auto shopping sites and other digital destinations.

We saw little change from 2019 to 2020 for share of impressions, with only a 3% drop. Whereas the share of ad spend was up 18%. However, this year the numbers have taken a nosedive, dropping by two-thirds for both share of ad spend and impressions compared to 2020. Automakers and dealers plan to spend less on advertising this holiday season, following a year of supply chain disruptions. Some auto dealerships have been left with roughly one-third of their normal inventory levels, leaving little reason for brands to pay out for holiday ads.

Retail

Also, referred to as the "Golden Quarter," for many retailers, holiday shopping is when they make the majority of their annual revenue. While the retail sector took a big hit last year, struggling under declining sales, retailers are getting ready to go head-to-head as they keep up with the strong projections this Black Friday through New Year's Eve cycle, and ad budgets are set to see a return to pre-pandemic days.

Our data mirrors this trend, as we saw both the share of ad spend and impressions dropped by 25% in 2020. However, this year's levels bounced back to those seen in 2019. It is no surprise that this is a similar pattern to the food and alcohol industry. When it comes to holiday shopping, the two go hand in hand, as people shop for parties, family get-togethers, and presents.

This has resulted in a quick recovery for the retail industry, as businesses prepare to greet more customers in-store, with bustling shopping centers and trips to see Santa.

Key Takeaways

While the pandemic caused an immediate pullback in ad budgets in 2020, following a review of our data we're predicting a healthy demand over the 2021 holidays for many industries, with the food, tech, and retail industries looking forward to solid ad spend.

Global supply chain disruptions have prompted inventory issues across multiple categories; meaning automotive advertising is down this year, due to a shortage in supply. But publishers and advertisers should be prepared as we head into the thick of the holiday season; the National Retail Federation says it anticipates nearly 2 million more people will shop from Thanksgiving Day through Cyber Monday alone. So make sure you have the video content brands want to appear next to and users love.