This is a good opportunity to share some insights from Primis data, collected from 2.5 billion opportunities per month across 19 primary industries. Using this data, we are able to forecast what to expect this holiday season, and determine what characteristics are shared by the publishers that maximize video ad revenue opportunities during these most lucrative of months.

‘Tis The Season To Advertise

Let’s start at the bottom line.

The average daily ad impressions for publishers in Q4 can be more than 50% higher than the average for the rest of the year, according to Primis data. As we approach Christmas and Thanksgiving, the daily ad impressions get even higher.

November and December are the most important months of the year for consumers, and advertisers spend more in order to be at top of mind. Not all the budgets are spent on the holidays themselves, as shoppers often search for gifts in advance, and can place the order weeks before the actual holiday. Therefore, it is important for advertisers not to miss out on the opportunity to reach consumers also in the weeks leading up to the holidays.

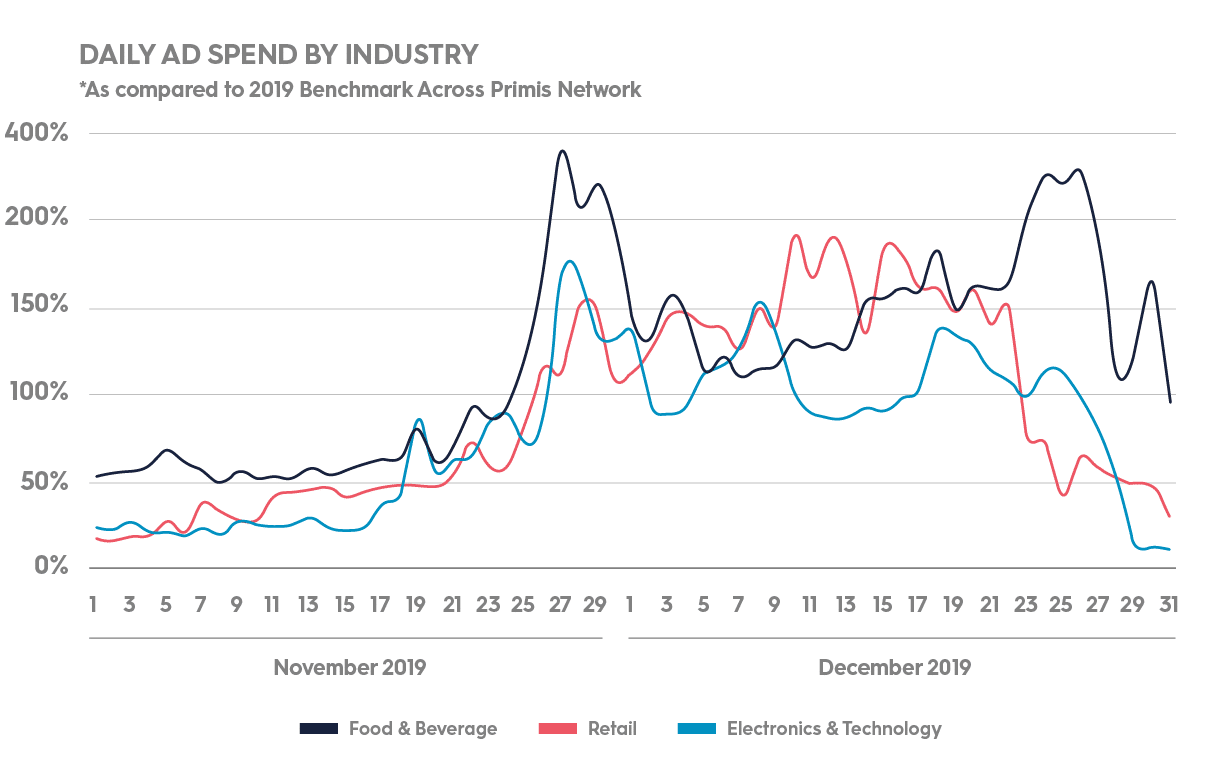

The Big Spenders: Food, Tech and Retail

Three categories pop out when looking at advertiser spend towards the holidays: Food & Beverage, Electronics & Computers, Retail.

Food & Beverage advertising budgets are unique in that they see the highest growth, begin to rise the earliest, and stay high the longest. This is probably caused by peoples’ interest in food and drink extending to New Years celebrations.

However, all three of the industries jump a few days before Thanksgiving and remain elevated through Christmas. While they spend their budgets on a wide variety of website categories, some verticals get a larger cut of the advertising pie.

The Big Earners

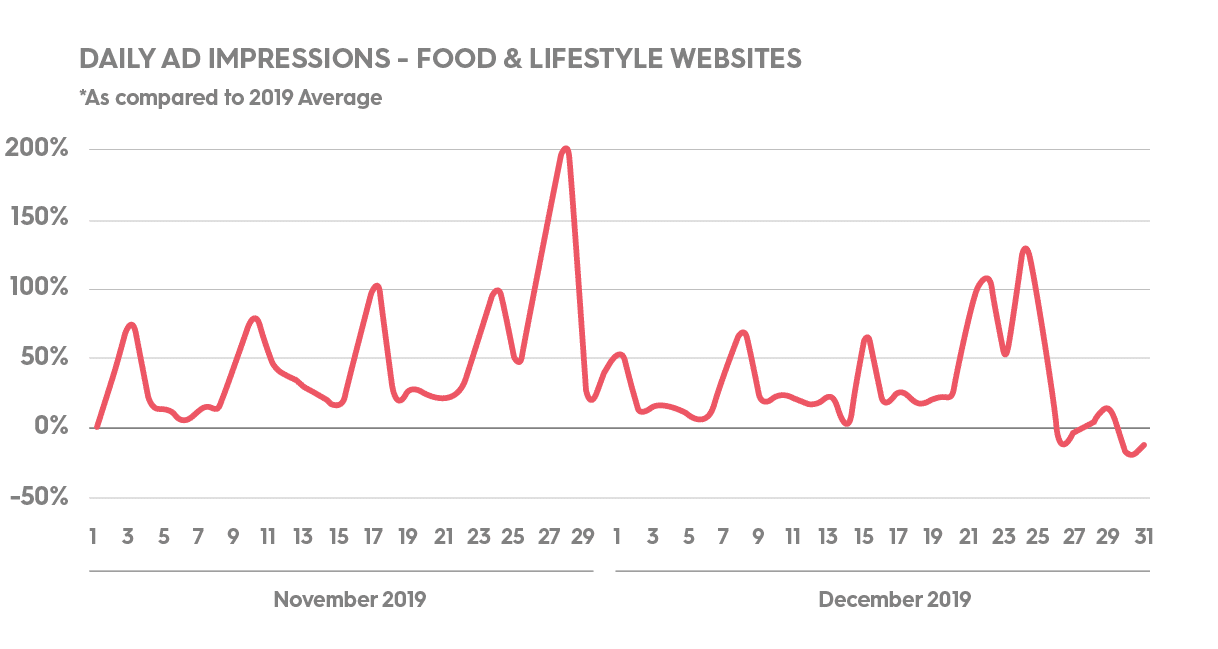

Speaking of pie, on the other end of the advertising chain, the publishing sector seeing the biggest growth in the Primis network is Food & Lifestyle. Many people are having family and friends over for the holiday, even during the pandemic, and are expected to cook some delicious meals. That means that there is a lot of traffic coming to recipe sites, and having people in a cooking state of mind is great for Food & Beverage advertisers.

In 2020, it will probably be a bit different. Nonetheless, it stands to reason that people will continue to prepare holiday meals even in a lockdown. In fact, the Cooking category of publishers saw impressive growth at the onset of lockdowns, as seen in our covid consumption and engagement reports.

For Food & Lifestyle websites, the peaks that you see in the above graph represents an increase of impressions by almost 200% on Thanksgiving Day and over 100% on Christmas Eve.

The growth on Food & Lifestyle sites is a combination of three elements.

First, are the advertising budgets that are at their peak. Especially Food & Beverage ads targeting contextually relevant sites.

Next is traffic growth. According to Primis research, traffic can grow up to 110% before Thanksgiving and 80% before Christmas.

Lastly, there is the time spent on site. Duration on-page grows before Thanksgiving and Christmas by around 35%. Meanwhile, network-wide duration growth stands at 20% before Thanksgiving, and just 10% leading up to Christmas.

What Can Publishers Do?

Based on what we’ve seen, publishers have a very important mission. There are very large budgets out there looking for quality inventory across display, sponsorships, and especially video. Focusing your efforts on growing and maintaining video inventory, especially at the end of the year, is going to go a long way in making it a merry holiday and a happy new year.